Information Publication Scheme

Information Publication Scheme

The IGTO has established an Information Publication Scheme (IPS) has been established under the Freedom of Information Act 1982 (FOI Act).

The FOI Act requires agencies from 1 May 2011 to publish:

- specified information on agency operations under the IPS

- information accessed in response to FOI applications in a disclosure log.

The FOI Act also encourages proactive publication of information held by an agency.

The Inspector-General of Taxation and Taxation Ombudsman (IGTO) provides the following information in accordance with the IPS and will continue to identify and publish information accessible through this website. See the IGTO’s agency plan to implement the IPS for further information.

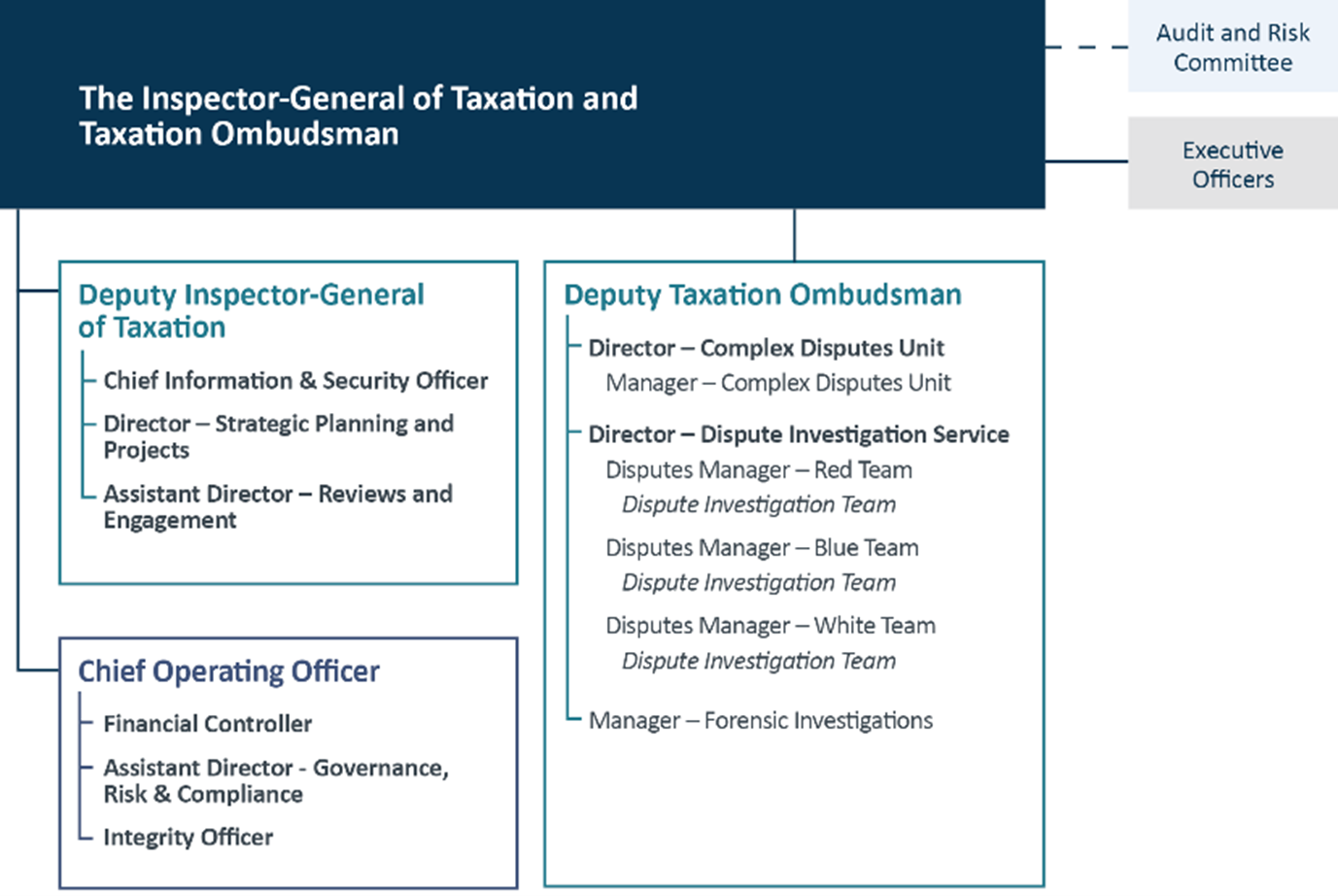

Who we are

Our organisational structure

Inspector-General of Taxation and Taxation Ombudsman: Karen Payne

A/g Deputy Taxation Ombudsman: David Pengilley

A/g Deputy Inspector-General of Taxation: Duy Dam

The Inspector-General of Taxation is appointed by the Governor-General pursuant to section 28 of the Inspector-General of Taxation Act 2003 (IGT Act). The appointment is made for a period of 5 years.

All other staff of the IGTO are employed under the Public Service Act 1999 (PS Act).

What we do

Our reports and responses to Parliament

Annual reports

Reports to Parliament

We conduct review investigations and report to Government on findings, observations and recommendations. Following the completion of an investigation, we may publish the report ourselves or, if the report contains a recommendation to the Government, provide a copy of that report to the Minister to the consider and publish.

All review investigation reports are available on our Completed Investigation Reports page.

Information routinely provided to Parliament

The following information can be found on the IGTO website on the Senate Orders page.

- IGTO file titles

- IGTO’s contracts ($100 000 or more)

- Departmental and Agency Appointments (since 2011)

- Departmental and Agency Grants (since 2011)

Routinely requested information and Disclosure Log

- Disclosure Log

- OAIC’s FOI Guidelines

- Attorney-General’s FOI Guidance Notes

- Request for Information under FOI

Consultation arrangements

Our current consultations and how to lodge are submission are set out in our Current Investigations page.

Operational information

- Accountable Authority Instructions

- Procedures for determining suspected breaches of the Code of Conduct

Our priorities

We publish a Corporate Plan by 31 August each year. The Corporate Plan sets out our vision, purpose and strategic priorities. The IGTO’s Corporate Plans are located on our Corporate Plans page.

Our finances

Information regarding IGTO legal expenditure and grants is located on the IGTO website on our Senate Orders page.

Details of our financial statements are set out in our Annual Reports published each year.

Our lists

Information regarding IGTO lists is located on the IGTO website on the Senate Orders page.

IGTO invites comment on IPS

Comments or complaints regarding the IGTO’s IPS information holdings and whether they are easily discoverable, understandable and machine-readable can be provided to the FOI contact below. The IGTO will arrange to make documents available in alternative forms upon request where possible.

Contact us

Email: [email protected]

Telephone: (02) 8239 2111

Last reviewed: September 2023

Information Publication Scheme

The IGTO has established an Information Publication Scheme (IPS) has been established under the Freedom of Information Act 1982 (FOI Act).

The FOI Act requires agencies from 1 May 2011 to publish:

- specified information on agency operations under the IPS

- information accessed in response to FOI applications in a disclosure log.

The FOI Act also encourages proactive publication of information held by an agency.

The Inspector-General of Taxation and Taxation Ombudsman (IGTO) provides the following information in accordance with the IPS and will continue to identify and publish information accessible through this website. See the IGTO’s agency plan to implement the IPS for further information.

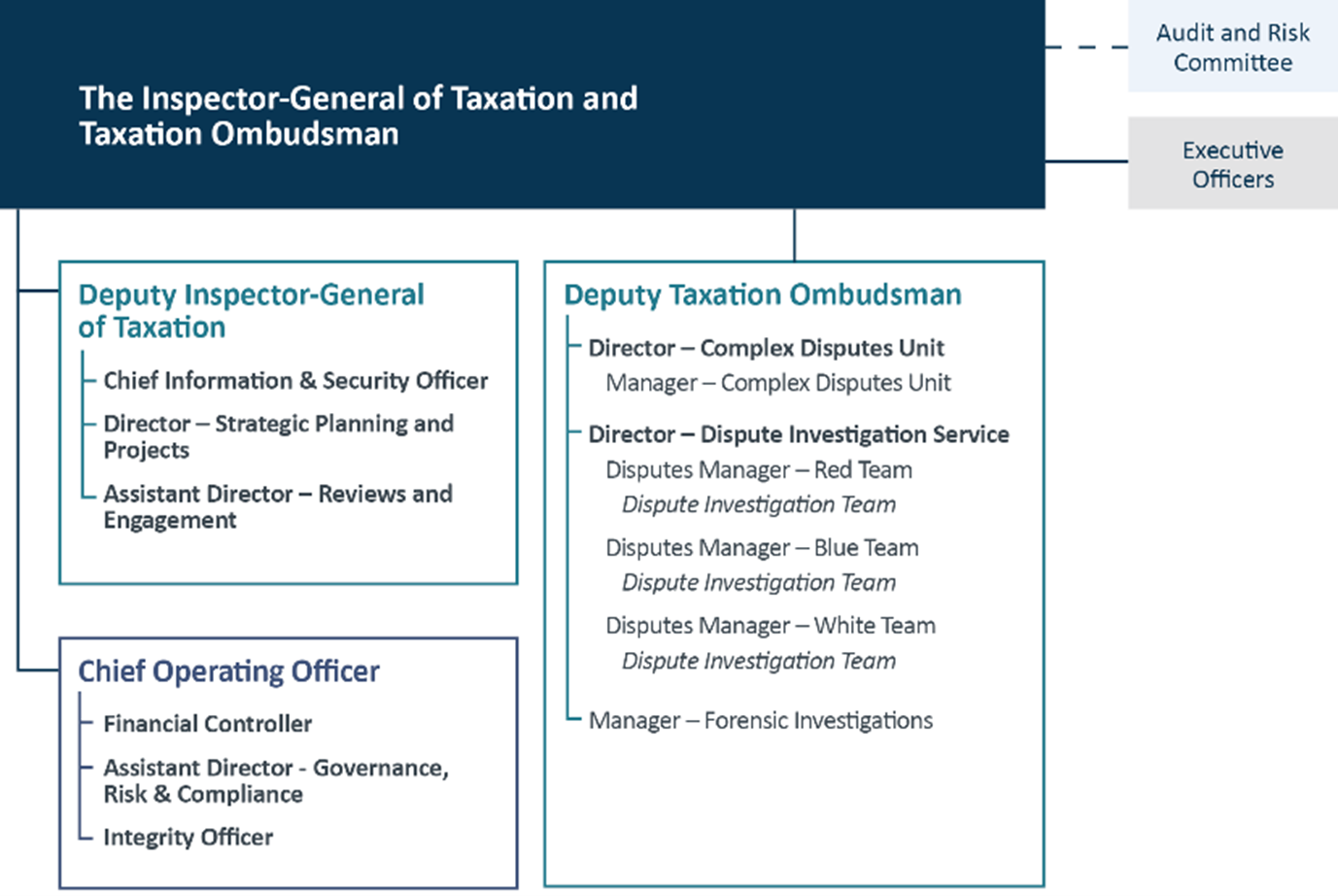

Who we are

Our organisational structure

Inspector-General of Taxation and Taxation Ombudsman: Karen Payne

A/g Deputy Taxation Ombudsman: David Pengilley

A/g Deputy Inspector-General of Taxation: Duy Dam

The Inspector-General of Taxation is appointed by the Governor-General pursuant to section 28 of the Inspector-General of Taxation Act 2003 (IGT Act). The appointment is made for a period of 5 years.

All other staff of the IGTO are employed under the Public Service Act 1999 (PS Act).

What we do

Our reports and responses to Parliament

Annual reports

Reports to Parliament

We conduct review investigations and report to Government on findings, observations and recommendations. Following the completion of an investigation, we may publish the report ourselves or, if the report contains a recommendation to the Government, provide a copy of that report to the Minister to the consider and publish.

All review investigation reports are available on our Completed Investigation Reports page.

Information routinely provided to Parliament

The following information can be found on the IGTO website on the Senate Orders page.

- IGTO file titles

- IGTO’s contracts ($100 000 or more)

- Departmental and Agency Appointments (since 2011)

- Departmental and Agency Grants (since 2011)

Routinely requested information and Disclosure Log

- Disclosure Log

- OAIC’s FOI Guidelines

- Attorney-General’s FOI Guidance Notes

- Request for Information under FOI

Consultation arrangements

Our current consultations and how to lodge are submission are set out in our Current Investigations page.

Operational information

- Accountable Authority Instructions

- Procedures for determining suspected breaches of the Code of Conduct

Our priorities

We publish a Corporate Plan by 31 August each year. The Corporate Plan sets out our vision, purpose and strategic priorities. The IGTO’s Corporate Plans are located on our Corporate Plans page.

Our finances

Information regarding IGTO legal expenditure and grants is located on the IGTO website on our Senate Orders page.

Details of our financial statements are set out in our Annual Reports published each year.

Our lists

Information regarding IGTO lists is located on the IGTO website on the Senate Orders page.

IGTO invites comment on IPS

Comments or complaints regarding the IGTO’s IPS information holdings and whether they are easily discoverable, understandable and machine-readable can be provided to the FOI contact below. The IGTO will arrange to make documents available in alternative forms upon request where possible.

Contact us

Email: [email protected]

Telephone: (02) 8239 2111

Last reviewed: September 2023